This study unveiled that the social benefits attained in case of solar power are greater than the social cost.

Cost benefit analysis and feasibility study of solar panels.

Over a 30 year period the financial benefits of installing solar panels on the almond ranch proved to outweigh the financial costs.

This study investigates the effectiveness of the solar powered photovoltaic system over the conventional and hybrid systems through a benefit cost analysis.

How much does a solar panel system cost.

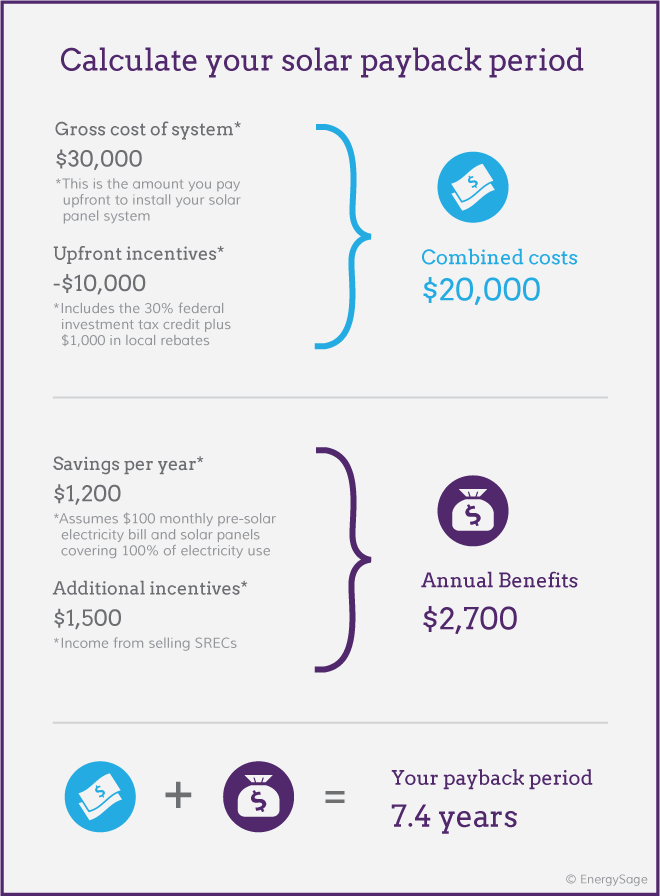

Solar panel systems qualify for a number of rebates tax credits and incentives that significantly reduce the cost of a solar energy system.

Section 5 evaluates the economic viability of solar energy.

However the high startup capital keeps the customers away from solar power.

For example the average annual electricity consumption of a u s.

Benefit and cost components were quantified from the economic and environmental perspectives.

Energy information administration to generate that 10 9 kwh of electricity a house in southern new england would need a system roughly 7 kw to 10 5 kw at a cost of approximately 26 000 to 39 000 or 0 see below.

Finally section 6 presents.

Assuming you pay for your solar panels upfront the installation of a solar system can increase the value of your home.

Studies have shown that homes with solar panels tend to sell faster and go for a higher premium.

Benefit cost analysis of solar power over on grid electricity for residential systems 2016 california net energy metering ratepayer impacts evaluation 2013 evaluating the benefits and costs of net energy metering in california 2013.

Section 3 examines the economic feasibility of implementing pv solar power in the state of kuwait by determining the levelized cost of electricity lcoe.

That premium often offsets the initial cost to install solar panels in the first place.

How solar renewable energy certificates srecs add extra.

An alternative energy system like solar power.

Section 4 presents the cost benefit analysis of implementing pv solar system in the state of kuwait.

Rebates tax breaks and incentives offset your costs.

The federal investment tax credit itc for solar.

This conclusion is based on the cost benefit analysis that provides a net present value of over 360 000 an internal rate of return of 11 9 as well as an investment resulting in positive cash flows after 11 years.

These were a 3 inch multi course extensive roof with a geosynthetic drain layer and a 6 inch semi intensive roof.